Explore hard money loans for renovation projects in Costa Rica. Unlock flexible funding options for your property rehab and get quick approval with us.

How to buy a home with owner financing in Costa Rica

Learn how to buy a home using owner financing.

Buying a home with owner financing in Costa Rica can be challenging and overwhelming. At Gap Equity Loans, we understand that securing financing for a home purchase in a foreign country can be an intimidating experience, which is why we are committed to providing our clients with the guidance they need to make informed decisions.

Here are some critical steps to help you navigate the process of buying a home with financing in Costa Rica:

Understanding Financing and Owner Financing

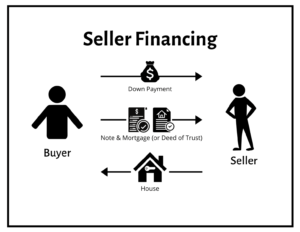

Owner financing in Costa Rica is when a real estate seller gives the buyer a loan to purchase the property by making monthly payments. This private finance can help speed up the purchase process and buy time to get approved for a traditional mortgage. The buyer and seller agree on a price, interest rate, and other parameters. The down payment size will generally determine how much the seller will finance.

The Process

Step 1: Determine Your Budget

This will help narrow your search and ensure you only look at homes within your price range. It is essential to consider all costs associated with purchasing a home, such as closing costs, property taxes, and necessary repairs.

Step 2: Find a Real Estate Agent

Finding a reliable real estate agent, such as Gap Real Estate, is critical to a successful home purchase in Costa Rica. A real estate agent can help you navigate the process, including finding properties that meet your criteria, negotiating with sellers, and assisting with closing. When selecting a real estate agent, could you research and find one with experience and a strong reputation in the Costa Rican real estate market?

Step 3: Plan your Loan

Before starting your home search and getting your hopes up, organizing your loan prior is a good idea. Please email Gap Equity Loans with your thoughts here, and you will be given here, and you will be given here, and you will be given the necessary information. This will give you a clear understanding of the amount you can afford to borrow and help you negotiate a better deal when making an offer on a property. When obtaining loan options, compare rates from multiple lenders and choose the one that offers the best terms and conditions.

Step 4: Find Your Dream Home

With your budget and loan pre-approval, you can now start searching for your dream home in Costa Rica. You can work with your real estate agent to find properties that meet your criteria and schedule showings. When you find a property you are interested in, please inspect it by a proven professional to ensure that it is in good condition and free of any hidden problems.

Step 5: Negotiate and Close the Deal

Once you have found your dream home, it is time to make an offer. Your real estate agent can assist with the negotiation process and ensure that the terms of the sale are favorable to you. If the seller accepts your offer, closing the deal is next. This process can be complex, but with the help of your real estate agent and a reputable lawyer, you can ensure a smooth and successful closing.

Payment Choices

Option 1: Cash Purchase

Purchasing with cash is the most straightforward option that carries the most leverage for the buyer. Advantages of this strategy include not having to pay interest, applying for a loan, or needing a mortgage altogether. Buyers can negotiate a lower purchase price by paying with cash, making this a popular choice among those with available funds.

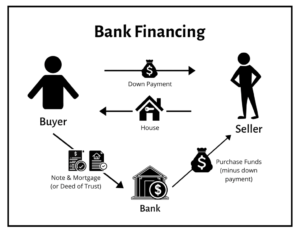

Option 2: Bank Financing

This option requires buyers to complete a loan application and to provide documentation, including proof of income. If approved, the buyer will receive a loan for the amount needed to purchase the property, which is easier said than done. Costa Rica banks have strict filtering, especially with foreigners, and will generally only accept people who are perfect candidates in their eyes. The loan will be repaid over a set period, usually 15 to 30 years, with interest charged on the outstanding balance.

Option 3: Private Financing

Companies such as Gap Equity Loans could assist you in financing your new home. Provided you can supply a down payment of 50% or more of the overall cost, Gap Equity Loans can find a private lender to get the rest of the way there with competitive interest rates compared to the local banking options. The Global Economy puts the average interest rate in Costa Rica at just over 14%.

Option 4: Joint Venture

This involves partnering with another individual or group to purchase a property together. Each partner contributes a portion of the funds needed to buy the property and shares in the profits and losses of the investment. Joint ventures can be a good choice for those who want to invest in real estate but need more funds.

Option 5: Owner Financing

This option which may only be available depending on the owner, involves the property seller providing the buyer with financing, usually in the form of a mortgage. The buyer then repays the loan over a set period, with interest charged on the outstanding balance. This option can be a good choice for those who have difficulty obtaining a bank loan or want a more flexible financing arrangement.

Benefits of Owner Financing in Costa Rica

Lower down payment:

This can make it easier for buyers to purchase a property, especially if they need more cash.

No credit check:

Unlike a traditional mortgage, owner financing does not usually require a credit check. This can benefit those with a poor credit history or those new to the country who still need to build a credit history.

Flexibility:

Regarding repayment terms, interest rates, and other loan details, owner financing can also offer more flexibility. This can make it easier for buyers to find a financing solution that works for them.

Faster closing:

As the buyer does not need to obtain a mortgage from a bank, owner financing can also result in a faster closing. This can be especially beneficial for those who need to purchase a property quickly.

Risks of Owner Financing in Costa Rica

Interest rates:

The owner is sets the terms, which means that the interest rate may be higher or lower than what a traditional mortgage would offer. This can make the loan cost more expensive in the long run.

Lack of protection:

As no third party is involved in the transaction, owner financing can also result in a lack of protection for the buyer. This can make it more difficult to resolve any disputes that may arise. Make sure you have a good contract with the seller.

Default:

If you fail to pay your bill, this can result in the loss of the property and the investment made by the owner, the same as any loan backed by collateral.

Legal issues:

Please ensure you work with your reputable lawyer rather than the homeowner’s lawyer to avoid unforeseen complications.

Gap Equity Loans is here to Help.

Here is a scenario: an expat without residency or in the process in Costa Rica.

Let’s assume you would like to buy a home for $200,000 USD, but you are not yet a permanent resident of Costa Rica, which can be a requirement from the local banks to be approved for a loan. You would have to come up with the cash yourself. No, there is another solution.

The Financing Solution

With our assistance and our sister company, Gap Real Estate, you can buy a home with owner financing.

While this process is underway, the Seller is asked to finance $120,000 USD at perhaps 8% for the first year, keeping in mind every case is unique and subject to differences. You (the buyer) are given a mortgage of $80,000 USD at 12%. You will have an average interest rate of 9.6%. The Global Economy beats the average mortgage loan rates at Costa Rican banks!

Of course, putting money down would be even more attractive… for example, if you had a property or business to sell back in your country of origin. But, there is often a time delay between selling your home or business and putting down a decent down payment.

Gap Equity Loans company generally helps process loans in terms of three years. “If you are never a day late or dollar short” on your loan payments, there is a good chance of renewing your loan. During these three years, you could have enough time to obtain your residency and apply for a traditional mortgage offered by a local bank.

Paying Off the Loan

When the sale of your home or business finalizes in your home country, you could have at least the 20-30% down payment required by a local bank to secure your new mortgage loan. Once you have the funds from your new loan, you will pay off your original mortgage with the seller. The title of the house moves from the trust to your name.

This example scenario could apply to Costa Rican citizens as well as foreigners. It is a feasible and viable solution for all parties involved — Realtors, Sellers, and Buyers.

As a foreigner, remember that once you have moved here and purchased a home, car, etc. In an amount exceeding $150,000 USD, you can apply for your residence through CRIE – Costa Rica Immigration Experts.

Conclusion

Owner financing can be an excellent option for those looking to purchase property in Costa Rica, but it is important to consider the benefits and risks before deciding. By weighing the pros and cons, you can make an informed decision that is best for you and your financial situation.

*Loan Request Form

“Gap Equity is hands down the best place for loans and investments. They’ve helped me out of a jam more than once.” -Bob.

Frequently Asked Questions

Can non-citizens purchase property in Costa Rica?

Yes, non-citizens can purchase property in Costa Rica. The country has become a popular destination for foreign buyers due to its favorable climate, natural beauty, and affordable real estate prices.

Is having a local bank account necessary to secure financing for a home purchase in Costa Rica?

While having a local bank account can make the loan approval process more accessible, it is not necessarily required. Many lenders, including Gap Equity Loans, offer financing options catering to foreign buyers’ needs.

Can I use the property I am purchasing as collateral for the loan?

Yes, you can use the property you purchase as collateral for the loan. This is common in Costa Rica.

How long does the loan approval process typically take?

The loan approval process can vary depending on the lender and the complexity of the loan. At Gap Equity Loans, we strive to provide a fast and efficient loan approval process, with approvals typically taking anywhere from a few days to a few weeks.

What types of properties are eligible for financing?

Gap Equity Loans offers financing for many properties, including single-family homes, condominiums, townhouses, and vacation properties.

Are there any restrictions on foreign property ownership in Costa Rica?

No, there are no restrictions on foreign property ownership in Costa Rica. Foreign buyers enjoy the same property rights as Costa Rican citizens.

Can I get a loan for a property still under construction?

Yes, you can get a loan for a property still under construction. This can be an intelligent way to secure financing for a property at a lower price point, with the potential for appreciation as the property is completed.

Contact us for more information, or fill out a loan request now!

Need Residency status in Costa Rica? – Click HERE.

Looking for Real Estate? – Click HERE.

Want to invest? – Click HERE.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)