Considering hard money loans in Costa Rica? Learn about the disadvantages, including high interest rates and strict terms, to make an informed decision.

Easy Application Refinance Loans in Costa Rica With Gapequityloans.com

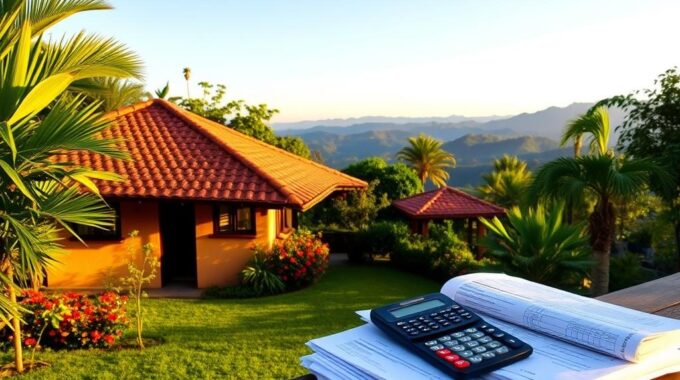

Refinance Equity Loans in Costa Rica offer a new financial approach for homeowners. It allows them to use their home’s value. GAP Equity Loans leads the way. They offer easy and flexible equity loan options. These options in Costa Rica make refinancing simpler and match various financial goals.

Key Takeaways:

- Competitive interest rates ranging from 12% to 16% for mortgage refinancing in Costa Rica

- Access to up to 50% loan-to-value of property’s market value when refinancing with GAP Equity Loans

- Quick loan approval process typically takes 7 to 10 business days, faster than traditional banks

- Flexible repayment terms ranging from six months to three years to suit diverse financial needs

- Over two decades of industry experience positioning GAP Equity Loans as a trusted provider of home loan refinance in Costa Rica

The Benefits of Refinancing Your Home Equity Loan in Costa Rica

Refinancing your home equity loan in Costa Rica can give you better financial options. Companies like GAP Equity Loans provide many benefits to homeowners.

Unlock Competitive Interest Rates

Refinancing can get you better rates on your equity loan. GAP Equity Loans offers lower rates than other loans, like those from your credit card.

Access Flexible Loan Amounts

With GAP Equity Loans, you can get more money. They let you borrow up to half your property’s value.

Potential Tax Benefits

Refinancing might lower your taxes. It can be part of a smart financial plan that saves you money.

Quick Approval and Personalized Service

GAP Equity Loans makes the process fast and easy. They focus on getting you approved quickly and offer loans that fit your needs.

Application Refinance Loans in Costa Rica

Refinancing with GAP Equity Loans is great for property owners. It offers low-interest rates, easy repayment, and a straightforward process. The move to a refinance equity loan in Costa Rica is smooth with expert help. They know the ins and outs of Costa Rican property loans.

Initiate the Application Process Seamlessly

Starting with GAP Equity Loans is easy. You can apply online or talk on WhatsApp for personalized help. They work fast but carefully to approve loans quickly. They make sure the loan fits your financial and time needs. Every property’s value is carefully checked to make fair loan offers.

Benefit from Competitive Interest Rates

GAP Equity Loans is known for good rates. They offer private loans in Costa Rica at rates from 12% to 16%. These rates are lower than many banks, saving you money in the long run.

Flexible Repayment Terms

GAP Equity Loans offers many ways to pay back. Whether you need a short or long loan, they can adjust. Their terms range from six months to three years. This helps fit the loan into your budget.

Rapid Loan Approval

Getting a loan is fast with GAP Equity Loans. They move quickly but take time to look at your property right. This makes their deals fair and fit your needs.

Why Choose Gap Equity Loans for Your Refinancing Needs?

Gap Equity Loans is a top choice in Costa Rica for property owners looking to refinance. They offer more benefits than traditional banks. For those looking for great equity loans and excellent service, Gap Equity Loans is a preferred option.

Industry Experience and Expertise

Gap Equity Loans stands out not just for the loans they offer but for their fast service. With over 20 years in the business, they are leaders in the Costa Rica property loan market.

Streamlined Funding Process

One unique thing about Gap Equity Loans is that they act as both lenders and agents. This means a better, tailored loan process. They truly understand their clients’ financial needs and goals, which makes them highly trusted.

Client-Centric Approach

Customers have a lot of good things to say about Gap Equity Loans. They praise the company’s reliability and commitment. This places Gap Equity Loans at the top for being focused on their clients’ needs in Costa Rica.

Refinancing with Gap Equity Loans: A Seamless Process

GAP Equity Loans offer a smooth and helpful service for refinancing. They strike a balance between good rates, easy processes, and flexible payments. As a leading provider, they aim to help borrowers reach their refinancing goals with dedication. This makes them a strong choice for anyone looking to update their finances.

Understanding the Refinancing Process

Securing quick loans with GAP Equity Loans is efficient. They approve loans in a timeframe of 7 to 10 business days, much faster than traditional banks. There are no upfront fees and less paperwork. Plus, you’ll work with top-notch experts. This marks them as a top pick for those needing fast and reliable financial services in Costa Rica.

Competitive Interest Rates

GAP Equity Loans have interest rates from 12% to 16%. This is great for those wanting lower rates or payments on their home equity loans in Costa Rica.

Tailored Repayment Options

GAP Equity Loans let borrowers choose from 6 months to 3 years for repayments. This flexibility is ideal for different financial situations, like debt consolidation or refinancing a property.

Efficient Loan Approval

Getting a home equity loan with GAP Equity Loans is quick, taking normally 5 to 10 days. This speed is perfect for borrowers wanting to refinance or use their property’s equity without delay.

Unlock the Financial Potential of Your Costa Rican Property

GAP Equity Loans offers unique gap equity loans in Costa Rica, making them stand out in the financial world. They help clients get through complex money issues. If you’re thinking about refinancing your home equity loans in Costa Rica, they can help. GAP Equity Loans works with your financial plan, making sure your mortgage refinancing boosts your financial power. Besides quick cash, these loans offer long-term money stability and growth.

Explore Equity Loan Refinancing Options

GAP Equity Loans is a top choice for equity loan refinance lenders in Costa Rica. They feature an easy and clear loan process. With good rates, flexible payments, and loans that fit your money needs, they focus on keeping you happy.

Bespoke Private Gap Equity Loans

GAP Equity Loans offers specially made private gap equity loans in Costa Rica. They meet all kinds of financial needs for property owners. Knowing a lot about real estate investment and property ownership regulations, they create loans that really work for you. These loans bring out the best in your financial situation.

Streamlined Refinancing Experience

Refinancing with GAP Equity Loans is smooth and easy. They cut down on the work and costs for you. They focus on mortgage refinancing and loans for expats. This helps make your Costa Rican property financially strong like never before.

Economic Advantages and Flexibility

Working with GAP Equity Loans opens doors to many refinance rates and home equity loan options. These can work wonders for your money, whether you’re combining debts, lowering interest, or looking into new costa rican banking options. Their flexible, customer-first approach makes them your best partner in financial growth.

A Reliable Partner for Financial Growth

GAP Equity Loans is known for its reliability in Costa Rica. They shine in Costa Rica real estate financing. If you need a private equity loan in Costa Rica or want to refinance, they’re your go-to partner.

Transparent and Customer-Centric Approach

GAP Equity Loans are all about being open and customer-focused. They offer great rates and tailor-made plans for each customer. This has made them a top choice for equity loan refinancing.

Competitive Rates and Personalized Solutions

They stand out by providing competitive rates and quick approvals. Their aim is to help homeowners and investors reach their financial goals. With their knowledge in Costa Rica’s real estate and customer-focused tactics, they lead in debt consolidation refinance and investment property refinance.

Steps to Successful Refinancing in Costa Rica

If you’re facing high-interest rates, refinancing is a good move. It also helps if you need to stretch out the time you have to pay back. Gap Equity Loans offer solutions to refinance in Costa Rica. After applying, our team swiftly checks out your property. This is to see how private lenders can refinance your loan.

Determine If Refinancing Is Right for You

We value honesty, a key to working with the private lenders we recommend. We stay away from risky loans that could cause foreclosure. If your loan situation has changed, refinancing with a private lender might work for you.

Research Lenders and Compare Options

At Gap Equity Loans, we guide you on different paths to find a solution. We can help with expenses like condo fees or property taxes during the refinancing process.

Gather Required Documents

We make the process clear and smooth for clients in Costa Rica. Our experts lead you through the refinancing application every step. They make sure the solution we find meets your refinancing needs.

Apply for Refinancing and Close the Loan

With lenders like Gap Equity Loans, you stand to enjoy benefits like lower rates and flexible terms. They also help you understand possible tax benefits. We’re known for our top-notch service, making your journey to financial wellness a smooth one.

Conclusion

In Costa Rica, GAP Equity Loans stands out as a dependable equity loan giver. They are known for their flexible solutions that meet customers’ changing needs. With their low equity loan rates and quick approvals, they aim to support homeowners and investors. They help on the path to financial growth and stability.

GAP Equity Loans is a name you can trust in Costa Rica’s real estate financing. They are praised for being clear and focusing on their customers. Their competitive rates and custom solutions have made them a top choice for equity loan refinancing. No matter what you want – like lower monthly payments, debt consolidation refinance, or investment property refinance – they have your back. They offer a way to realize your Costa Rican property’s financial potential.

Call To See If You Qualify For a Loan Today

Looking to refinance your loan in Costa Rica? Give GAP Equity Loans a call. Let their experts check if you meet the requirements for a loan. They’ll explain the process, like the refinance eligibility criteria and refinance closing costs. This can make your refinancing experience smooth and beneficial. Step into financial freedom by learning about the refinance rates and options in Costa Rica.

FAQ

What are the benefits of refinancing my home equity loan in Costa Rica?

Refinancing in Costa Rica offers you better interest rates and loan amounts that fit your needs. It may also provide tax breaks. Plus, you can get your loan approved fast and in a way that suits you.

How does the application process for refinancing loans in Costa Rica work with GAP Equity Loans?

Applying at GAP Equity Loans is easy. You start online or over WhatsApp. They offer low rates, flexible terms, and quick approvals.

Why should I choose GAP Equity Loans for my refinancing needs in Costa Rica?

Choose GAP Equity Loans for their deep knowledge, ease of process, and focus on you. They promise reliable service and work hard to meet your refinancing needs.

What are the steps to successfully refinance my loan in Costa Rica?

First, decide if refinancing is the right move. Then, look at your options, prepare your documents, apply, and close your loan.

Can GAP Equity Loans help me explore refinancing options and unlock the financial potential of my Costa Rican property?

GAP Equity Loans is your go-to for Costa Rica real estate, offering unique gap loans and smooth refinancing. This can bring you economic benefits and more financial options.

Source Links

- https://www.gapequityloans.com/en/refinance-equity-loans-in-costa-rica/

- https://www.gapequityloans.com/en/easy-refinance-loans-in-costa-rica-2/

- https://www.gapequityloans.com/en/how-to-refinance-your-loan-in-costa-rica/

- https://gapinvestments.com/en/mortgage-solutions-in-costa-rica/

- https://livingcostarica.com/costa-rica-real-estate-topics/my-mortgage-refinance-in-a-costa-rica-bank/

- https://www.gapequityloans.com/en/gap-equity-loans-for-foreclosure-refinancing/

- https://www.gapequityloans.com/en/costa-rica-home-equity-loans-guide/

- https://www.gapequityloans.com/en/loan-application-costa-rica/

- https://gapinvestments.com/en/private-money-lender-in-costa-rica/

- https://www.cliftonpf.co.uk/blog/02012018171808-how-to-get-a-bridging-loan-in-scotland/

- https://www.gapequityloans.com/en/equity-loans-faq/

- https://gapinvestments.com/en/secure-loans-in-costa-rica/

- https://gapinvestments.com/en/real-estate-development-loans-in-costa-rica/

- https://www.specialplacesofcostarica.com/blog/how-to-get-a-mortgage-in-costa-rica/

- https://gap.cr/expert-guidance-refinance-loans-gap-equity-costa-rica/

- https://www.gapequityloans.com/en/construction-loans/

- https://www.gapequityloans.com/en/commercial-loans/

- https://www.gapequityloans.com/en/costa-rica-home-equity-loans/

- https://gap.cr/home-refinance-loans-gap-equity-costa-rica/

- https://gap.cr/refinance-advantages-gap-equity-costa-rica/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)