Explore Costa Rica real estate financing options with us. We provide loans from $50,000 to $1,000,000 with competitive rates and flexible terms.

Costa Rica Equity Loans: Unlock Your Property’s Value With GAP Equity Loans.

Ever thought about the hidden value in your property in Costa Rica? Now, with Costa Rica Equity Loans, it’s a great time to see what your home is worth. By using GAP Equity Loans, you can get funds based on your property’s equity. This can help finance things like home improvements or new investments. Our loans start at $50,000 and have interest rates from 12% to 16%. We offer flexible payment plans to fit your budget.

The real estate market in Costa Rica is booming. It’s a perfect time to use your property’s value for financial gains. Equity loans costa rica make getting funds easier and might offer tax benefits and faster approvals than traditional banks. We can process your loan in as little as 7 to 10 business days, helping you reach your financial goals quickly.

Key Takeaways

- Access funds starting from $50,000 with competitive interest rates between 12% and 16%.

- Flexible loan terms ranging from 6 months to 3 years tailored to meet individual financial situations.

- Potential tax benefits may be available for some borrowers seeking equity loans.

- GAP Equity Loans processes approvals faster than traditional banks, often within 7 to 10 business days.

- With an increase in investment opportunities in Costa Rica, now is an ideal time to explore property equity loans.

Understanding Equity Loans in Costa Rica

Equity loans are a great way for homeowners in Costa Rica to use their property’s value. They let us borrow money for things like fixing up our homes or making personal investments. With options like costa rica equity financing, we can take advantage of good market conditions.

Definition and Benefits of Equity Loans

An equity loan lets us borrow against what our property is worth, up to 50% of its equity. The perks of these loans include:

- Access to a lot of money, from $50,000 to over $1 million.

- Lower interest rates than unsecured loans, usually between 12% and 16% a year.

- Flexible loan terms from 6 months to 3 years, fitting different financial needs.

The first step in getting an equity loan is figuring out our home’s value. This helps us understand if we’re eligible and what we can get from the loan.

How Equity Loans Work

Getting an equity loan has certain steps:

- Fill out a preliminary application with our financial info.

- Get a property appraisal to see how much equity we have.

- Look over loan offers with the best rates to make sure they work for us.

After we get approved, we can get our money in 7 to 10 business days. This makes it easier to finance our projects or investments fast.

Benefits of Using Your Property’s Value

Using our property’s value through home equity financing has many financial perks. It lets us know how much we can borrow and the benefits it offers. This makes the process more attractive.

Access to Significant Funds

Home equity loans in Costa Rica let us borrow from $50,000 to $3,000,000. This is a great way to handle big expenses or invest in something important. By using our property, we can get up to 50% of its appraised value.

This gives us the chance to improve our home or start a business. It opens new doors for us.

Low Interest Rates Compared to Other Financing Options

Low interest equity loans in Costa Rica have attractive rates. They range from 12% to 16%, which is better than unsecured loans or credit cards. GAP Equity Loans offers loans with rates as low as 12% per year.

This means we save money over time. And we get to enjoy the perks of home equity financing.

Equity Loans Costa Rica: The Process

Getting an equity loan in Costa Rica is important for those who want to borrow. We can make it easier by following a few steps and getting ready with the right documents. This way, we meet the requirements for equity loans in Costa Rica.

Steps to Apply for an Equity Loan

First, we pick a lender like Grupo GAP that offers good equity loan options in Costa Rica. Then, the process goes like this:

- Gather required documents.

- Submit the loan application.

- Await the property appraisal and financial review.

- Receive loan approval and terms.

Documents Required for Approval

We need to get ready with several documents for approval:

- Property title or deed.

- Recent financial statements.

- Proof of income.

- Identification documentation.

These documents help the lender check if we’re financially stable and if our property is worth something.

Loan Terms and Conditions

It’s key to know the terms of equity loans. Loans can be from $50,000 to over $1,000,000, based on the property’s value and the lender’s rules. Grupo GAP offers interest rates from 12% to 16%, which is lower than what banks charge. Loans can be paid back in 6 months to 3 years, so we can choose what works for us. Getting approved quickly, in 7 to 10 business days, is a big plus.

GAP Equity Loans: Your Trusted Partner in Financing

Finding the right equity loan lenders can be tough, but GAP Equity Loans is a top choice in Costa Rica. We have over 20 years of experience, giving us the skills to understand the real estate market well. We aim to offer financing solutions that help homeowners make the most of their property’s value.

Experience and Expertise in the Market

Our team knows the local real estate market inside out. We use our deep understanding of property values and rules to offer loan options that fit each client. With GAP Equity Loans, you get:

- Loan amounts from $50,000 to over $1,000,000 USD.

- Flexible loan terms from 6 to 36 months.

- Competitive interest rates between 12% and 16% annually.

- Quick loan approvals in 7 to 10 business days.

Competitive Rates and Flexible Terms

We offer personalized services for real estate investors. As top costa rica equity loan providers, we allow up to 50% of the property’s value for loans. This means our clients can get the funding they need for their investments. We provide various options and competitive benefits to help create successful home equity lending plans.

The property market in Costa Rica keeps growing, and we aim to help with that growth. By working with GAP Equity Loans, clients can make smart financial moves. Our expertise helps them succeed in the long run.

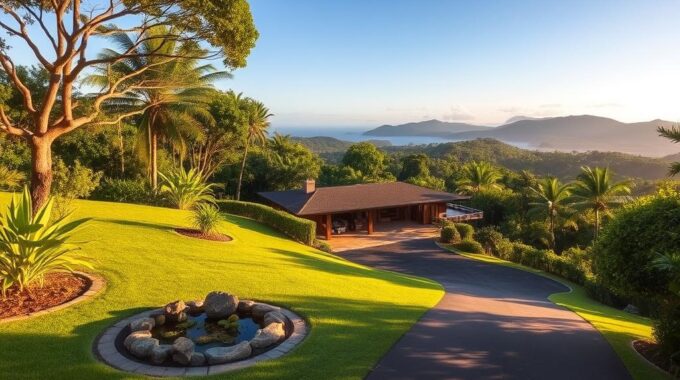

Real Estate Market in Costa Rica: A Booming Opportunity

The real estate market in Costa Rica is booming. Property values are rising, and there’s a big demand for luxury properties and condos. Investors from around the world are drawn to beautiful beachfront homes and exclusive communities. This makes it a great time for homeowners to use equity loans to increase their property’s value.

Insights into Property Values

Knowing how property values work is key to making the most of equity financing in Costa Rica. Properties here can earn returns of 12% to 16% each year with GAP Investments. This means homeowners can build a lot of equity in their homes. With interest rates for equity loans between 12% and 16%, homeowners can get a lot of money for projects. This makes Costa Rica a great place for real estate lending.

Growing Demand for Luxury Properties and Condominiums

There’s a big demand for luxury homes, condos, and gated communities. Homeowners are using the best equity loans in Costa Rica for investments or to improve their homes. GAP Equity Loans makes it easy to get approved and get money fast when you need it.

Now, buyers have more financing options than ever. Private lenders offer loans from $50,000 to over $3,000,000 with terms from 6 months to 3 years. This is great for investors and those wanting to develop properties. Equity financing is becoming more important as Costa Rica’s real estate market grows.

Using equity loans is a smart way to grow our investments in this booming market. For those looking for custom financing, services like equity financing in Costa Rica can really help.

Conclusion

Equity loans in Costa Rica are a great way for homeowners to get funds. You can use your home’s equity for things like fixing up your house or investing in real estate. With interest rates between 12% and 16%, costa rica home equity loans can help you reach your goals.

GAP Equity Loans makes getting a loan clear and easy. They let you use up to 50% of your property’s value. It’s key to keep your Loan-to-Value (LTV) ratio above 45% for the best loan terms. Loans start at $50,000 and can last from 6 months to 5 years, fitting different needs.

Want to know how low interest home equity loans can help you? Contact us to explore your options. Check if you qualify for a loan today! For more details, visit our frequently asked questions page. It has lots of info on getting a loan as a homeowner.

FAQ

What are equity loans in Costa Rica?

Equity loans in Costa Rica let homeowners borrow money using their property as collateral. They use the property’s appraised value. This way, you can get cash based on up to 50% of your home’s equity.

How much can I borrow with an equity loan?

You can borrow between ,000 and ,000,000 with an equity loan in Costa Rica. This depends on your property’s value and your financial situation.

What are the interest rates for equity loans in Costa Rica?

Interest rates for these loans are between 12% and 16%. This is often lower than rates for unsecured loans or credit card debt.

What is the application process for equity loans?

First, you gather documents like property titles and financial statements. Then, a property appraisal and a review of your financial history happen. You can expect approval within 7-10 business days.

What documents do I need to apply for an equity loan?

You’ll need to provide property titles, financial statements, proof of income, and other documents. These support your application for an equity loan.

What are the loan terms for equity loans in Costa Rica?

Loan terms range from 6 months to 3 years. This gives you flexible repayment options based on your financial situation.

Can I use an equity loan for home renovations?

Yes, you can use equity loans for many things. This includes home renovations, investments, or personal expenses. It lets you use your property’s value to your advantage.

Are there any tax benefits associated with equity loans?

Some borrowers might get tax deductions on the interest they pay. This can make using home equity even more financially beneficial.

How does the real estate market in Costa Rica affect equity loans?

Costa Rica’s growing real estate market means property values and demand are rising. This lets homeowners unlock more equity. Equity loans become a good option for investment and improving their homes.

Who are the leading providers of equity loans in Costa Rica?

GAP Equity Loans is a top provider. They offer competitive rates and over 20 years of experience in Costa Rica’s real estate market. They provide customized solutions for homeowners.

Source Links

- https://www.gapequityloans.com/en/about-equity-loans-costa-rica/

- https://www.gapequityloans.com/en/your-home-equity-in-costa-rica/

- https://gapinvestments.com/en/gap-equity-loans-for-real-estate-investing-in-costa-rica/

- https://www.gapequityloans.com/en/about-home-equity-financing-costa-rica/

- https://www.gapequityloans.com/en/understanding-home-equity-loans/

- https://www.gapequityloans.com/en/how-to-make-money-using-your-home-equity-in-costa-rica/

- https://gapinvestments.com/en/what-is-home-equity-in-costa-rica/

- https://www.gapequityloans.com/en/benefits-of-home-equity-loans-in-costa-rica/

- https://www.gaprealestate.com/expats-equity-loans-in-costa-rica/

- https://gap.cr/strong-home-equity-loans-in-costa-rica/

- https://www.gapequityloans.com/en/get-financing-in-costa-rica/

- https://gapinvestments.com/en/home-equity-lending-in-costa-rica/

- https://gapinvestments.com/en/costa-rican-real-estate-investment-opportunities/

- https://gapinvestments.com/en/costa-rica-private-loan-market-overview/

- https://www.gapequityloans.com/en/seize-real-estate-deals-in-costa-rica/

- https://gap.cr/smart-way-to-use-home-equity-in-costa-rica/

- https://www.gapequityloans.com/en/equity-loan-guidance-in-costa-rica/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)